In a continuation of the trend of greater tax transparency, which combines the UK Government’s obligations under the Fourth Money Laundering Directive (4MLD) with HMRC’s move towards digitalisation, the Government is introducing a new Trust Register.

In future, trustees will be required to comply with reporting regulations via an online Trusts Register. Unlike the People with Significant Control (PSC) beneficial ownership register for companies, the Trust Register will not be open to the public. It will only be available to law enforcement bodies and the UK Financial Intelligence Unit. There will also be a requirement for trustees to disclose their status as a trustee when entering in to business relationships.

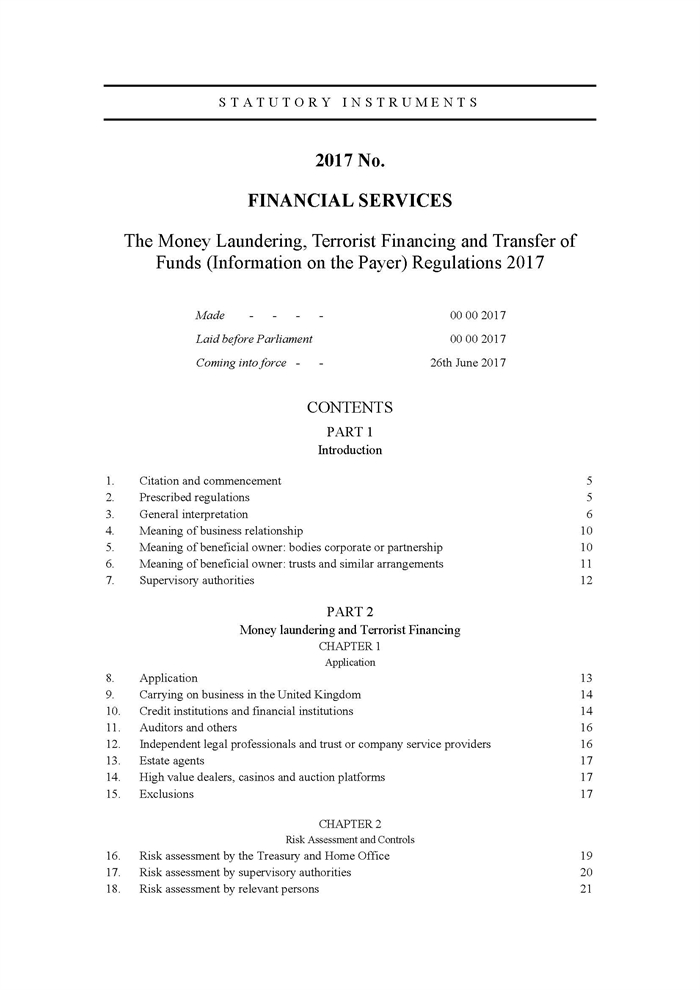

As expected the Government has now published documents providing further information about proposals for the UK’s register of the beneficial ownership of trusts. These documents include:

- a draft Statutory Instrument implementing 4MLD which is due to come into force on 26 June 2017; and

- the Government’s response to the consultation on 4MLD.

This will be an online Government register, which will apply to UK trusts. It will also apply to non UK trusts which receive income from a source in the UK or have assets in the UK on which there is a UK tax liability (this includes IT, CGT, IHT, SDLT or SDRT).

Trustees will need to update the register each year that a trust generates a UK tax consequence. They will be required to file various details such as the identity of the settlors, trustees and all other persons exercising effective control over the trust (if any) and the beneficiaries or a class of beneficiaries. The draft proposal also includes a requirement to provide a statement of accounts for the trust, describing the trust assets and identifying the value of each category of the trust assets (including the address of any property held by the trust).

For trusts in existence at that time, the first filing deadline will be on or before 5 April 2018. For trusts created after on or after 6 April 2018, the first deadline for filing will be the date on which the trustees first become liable to pay UK taxes. There will be an annual requirement before 5 April each year to either inform the Government of any changes or to provide notification that there have been no changes. For new trusts, a new online form (41G) will be available from June 2017.

The Government has provided further information within HMRC Trust and Estates Newsletter April 2017.

Although the rules are still in draft form and there could still be changes to some of the details required, it is anticipated that the statutory instrument will come into force on 26 June 2017. This is a significant change in reporting requirements for trusts.

It should be noted that the Government has also recently published further details of the public register of the beneficial owners of overseas entities owning UK properties.